CWP Market Insights – January 2025

As we begin the new year, it’s an excellent time to reflect on the events that shaped the financial markets over the past twelve months. In 2024, the stock market once again demonstrated its resilience, overcoming numerous challenges that could have disrupted its momentum, but ultimately had little lasting impact.

The S&P 500 delivered an impressive 24% return for the year, even amidst an unpredictable and unprecedented presidential election, escalating geopolitical tensions in the Middle East, and fewer Federal Reserve rate cuts than anticipated. This marked the second consecutive year of more than 20% gains for the index.

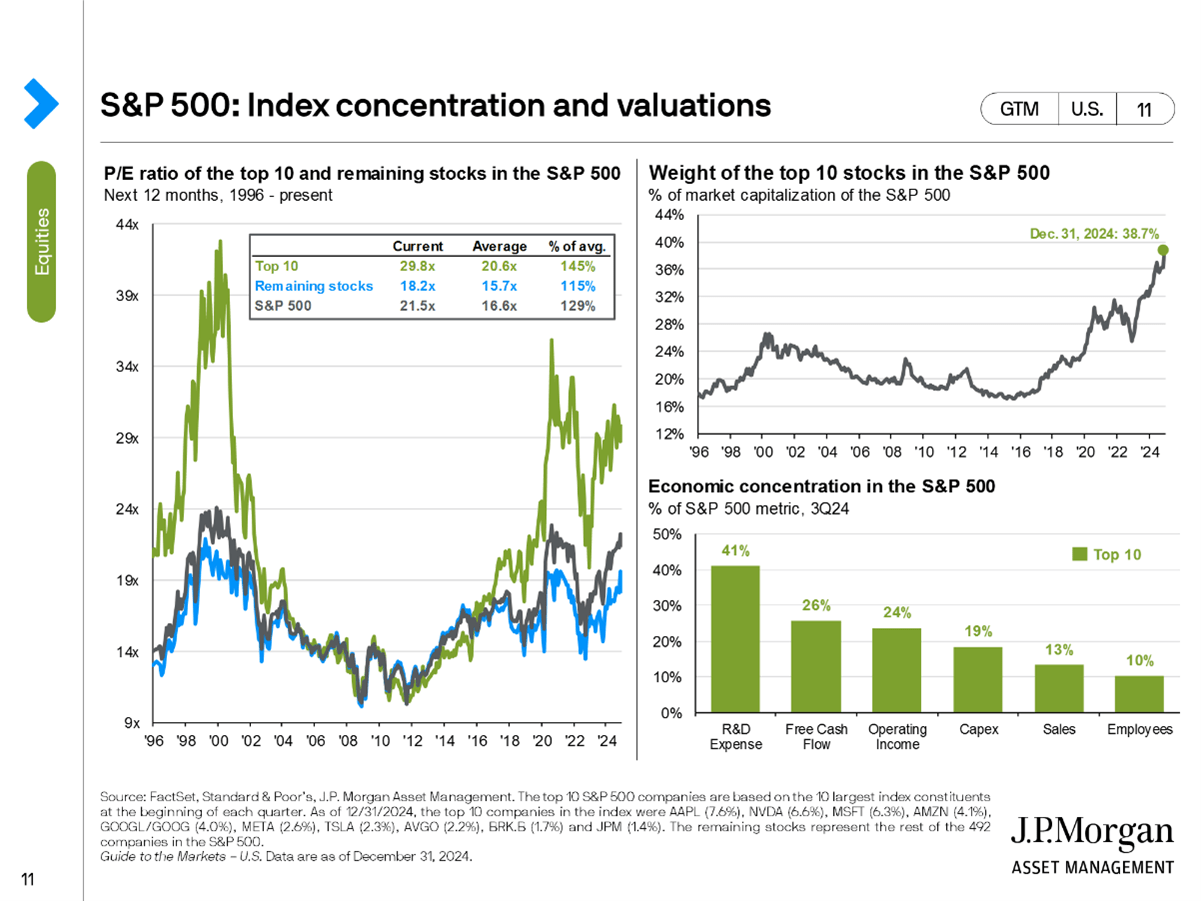

Several factors contributed to this remarkable performance, including a robust domestic economy, rate cuts (albeit fewer than expected), and significant advances in large growth stocks, particularly the “Magnificent 7” companies leading the way in artificial intelligence. These factors led to the index’s performance becoming concentrated to only a few sectors and names. To highlight this, of the 503 stocks that make up the S&P 500, 30% of them finished 2024 with a negative return.

What Lies Ahead?

After two years of extraordinary market gains fueled by a concentrated group of companies, many investors are questioning whether this trend will continue in 2025. While we remain optimistic about the broader market’s prospects, we anticipate a more balanced performance this year.

The long-term historical average annual return for the S&P 500 is 9.94%. Gains of over 20% in back-to-back years are exceptional, but not typical. As such, while the outlook for economic growth and corporate earnings remains positive, it’s reasonable to temper expectations for returns moving forward.

A More Balanced Market

One notable development from the past two years is the increasingly concentrated market. The 10 largest stocks in the S&P 500 now account for 38.7% of the index’s market capitalization, the highest level since 1990. Valuations for these companies are also elevated, with price-to-forward earnings ratios of approximately 29 times, compared to 18 times for the remainder of the index.

Unlike the tech bubble of the early 2000s, today’s rally is supported by strong earnings growth, which is a positive indicator. However, for markets to continue to move higher as the year progresses, we expect earnings to broaden out, with smaller companies in the S&P 500 playing a more prominent role in driving performance.

Where do we see opportunity in a shifting landscape?

Companies that are outside the Magnificent 7 club offer investors plenty of opportunities, with lower valuations and accelerating earnings. We anticipate sector leadership to broaden in 2025, presenting both opportunities and risks. Tech-related sectors, buoyed by AI enthusiasm in 2024, now carry high valuations and the risk of unmet investor expectations. To address this, investors should consider shifting Technology focus toward Software, which offers more reasonable valuations and consistent growth. The U.S. Financials sector is poised to benefit from moderate Fed rate cuts, a steeper yield curve, and increased capital markets activity. With recession risks easing, defensive sectors look less attractive except for U.S. Health Care which remains appealing for its stable earnings growth amid late-cycle economic uncertainties.

Diversification Still Matters

While U.S. large-cap equities have driven recent gains, their elevated valuations and concentrated nature highlight the need for caution. Amid uncertainty surrounding key policy decisions and near-term risks, diversification has never been more critical. In a market dominated by a small number of stocks, relying too heavily on a narrow group can lead to significant challenges if those companies lose favor. As always, diversification is one of the best ways to manage portfolio risk and position yourself to meet long-term financial goals.

For a more in depth look at markets including “The Ten Themes for 2025”, we encourage you to look at Raymond James’s Investment Strategy Quarterly publication.

The opinions expressed are those of Christopher Vidler and Eric Van Der Hyde and not necessarily those of Raymond James. There is no guarantee that the forecasts made will come to pass. This material does not constitute investment advice and is not intended as an endorsement of any specific investment or security. Please remember that all investments carry some level of risk, including the potential loss of principal invested. Diversification and strategic asset allocation do not assure profit or protect against loss.

The Magnificent Seven are a group of companies including Alphabet, Amazon, Apple, Meta Platforms, Microsoft, NVIDIA, and Tesla. The companies engaged in the communications and technology industries are subject to fierce competition and their products and services may be subject to rapid obsolescence.

The S&P 500 is an unmanaged index of 500 widely held stocks that is generally considered representative of the U.S. stock market. Keep in mind that individuals cannot invest directly in any index, and index performance does not include transaction costs or other fees, which will affect actual investment performance. Individual investor's results will vary.