2024 CWP Market Outlook

A year ago, as we sat down to write our 2023 CWP Market Outlook, the Financial Times had just published a survey the prior month showing that 85% of economists projected a recession in 2023. At the time, we certainly understood the reasons for this consensus expectation but noted “multiple catalysts that at any moment will allow markets to turn on a dime and move higher.” Then, shortly after the start of the year, the investment world learned about Artificial Intelligence or “AI” and technology stocks, in particular, began to rally. This sequence points to the question, “What’s something people are generally certain about that will be proven wrong?”

All major indices finished the year significantly higher in 2023 defying consensus. After the Fed rate hikes in 2022, many were calling for either a “hard landing” or a “soft landing”. But did we land at all? There was no recession in 2023 mostly because both company earnings and the consumer were far more resilient than expected. We also had the emergence of a catalyst, AI.

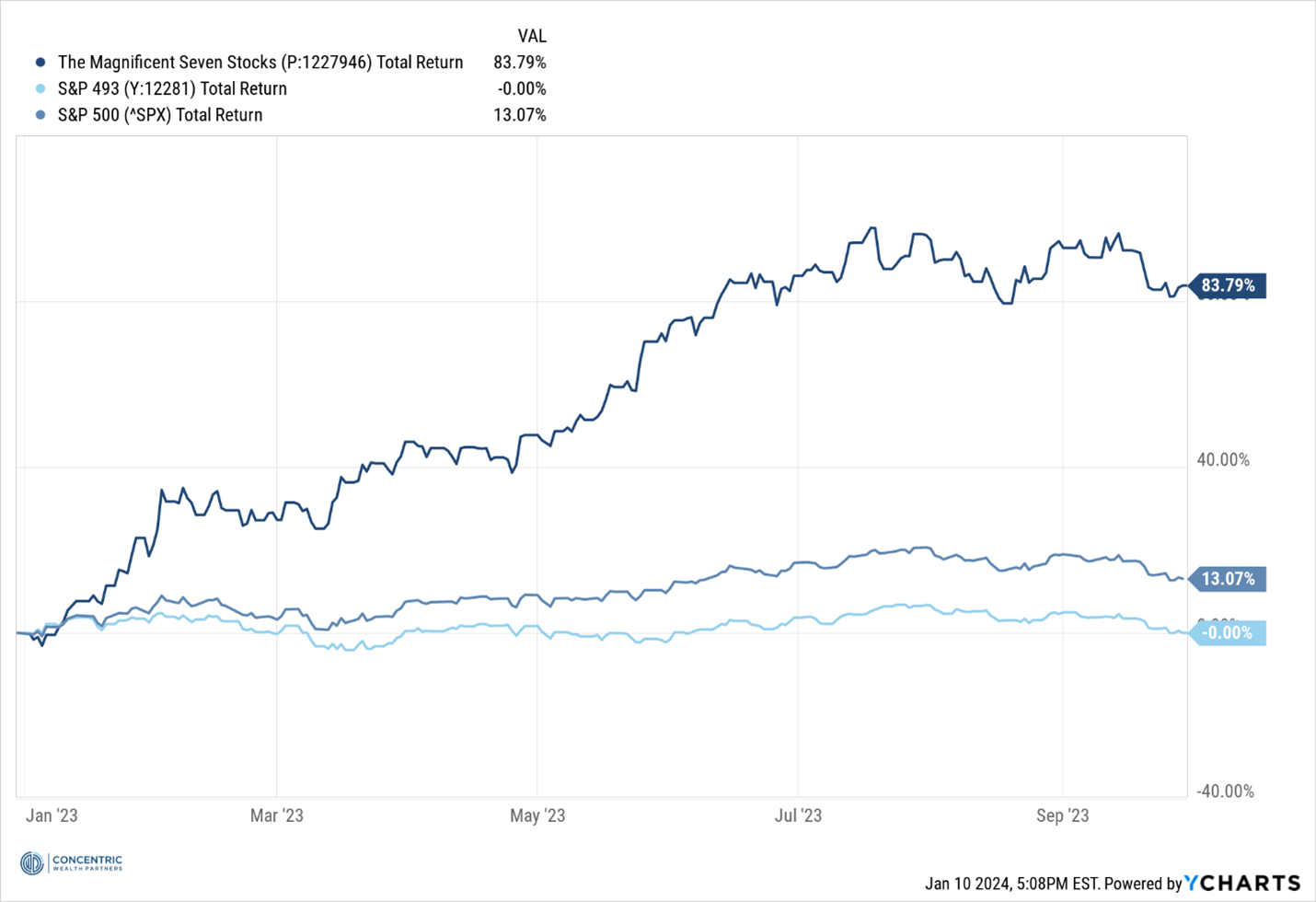

When you look back at last year, what became known as the “Magnificent 7” drove markets for most of the year because of the emergence of AI as an investment theme. Through the first 9 months of the year, these 7 stocks made up all the return of the S&P 500.

Figure 1: Comparison of January – September 2023 return of "Magnificent 7" to the S&P 500 and to the S&P 500 excluding the "Magnificent 7" stocks.

Historically, when you have such a divergence in return between only a few stocks and the rest of the market, this has been a positive opportunity for the “other” stocks in the following year or two. We think that’s likely the case headed into 2024, as we saw the S&P 493 from above rally roughly 10% in the final 2 months of 2023.

For 2024, we see the broadening out of market participation continuing; meaning that, instead of just one thing seeming to work, we think we could see all asset classes marginally higher this year as interest rates stabilize and then normalize. We favor a blend of both Defensive (Health Care & Consumer Staples) and Sensitive (Communications, Energy, and Technology) equity sectors in our portfolios. We’ll be watching both Small Cap and International Equities as valuation spreads compared to US Large Cap Equities are at some of the greatest levels in history.

A final word on economic forecasts. Market predictions are hard. It’s tough to know what consensus is thinking sometimes because everyone has a platform to promote their opinion. What is certain in all of it is that people will be wrong. We just don’t know what they’re going to be wrong about yet. The last few years have been great examples of expecting one outcome only to have a completely different outcome occur! From a Global Pandemic to unprecedented government spending, to a Fed tightening cycle at the fastest pace in history, there has been no shortage of surprises. While forecasting is hard, what we do know is most of the time (roughly 70% since 1900) markets go up when viewed on an annualized basis, but sometimes they go down. But over time, more will go right than it goes wrong, as market returns of 10-year rolling periods over the same amount of time are positive roughly 96% of the time. We feel confident this will continue to be the case going forward over the long haul.

If you’d like to learn more, please check out Raymond James’ Investment Strategy Committee report found here which includes the outlook for rates and discussion about market performance in a Presidential election year.

The opinions expressed are those of Christopher Vidler and Eric Van Der Hyde as of the date stated and are subject to change. There is no guarantee that the forecasts made will come to pass. This material does not constitute investment advice and is not intended as an endorsement of any specific investment or security. Information and opinions are derived from proprietary and non-proprietary sources. Options are not necessarily those of Raymond James.

Please remember that all investments carry some level of risk, including the potential loss of principal invested. Diversification and strategic asset allocation do not assure profit or protect against loss.

The S&P 500 is an unmanaged index of 500 widely held stocks that is generally considered representative of the U.S. stock market. Keep in mind that individuals cannot invest directly in any index, and index performance does not include transaction costs or other fees, which will affect actual investment performance. Individual investor's results will vary.